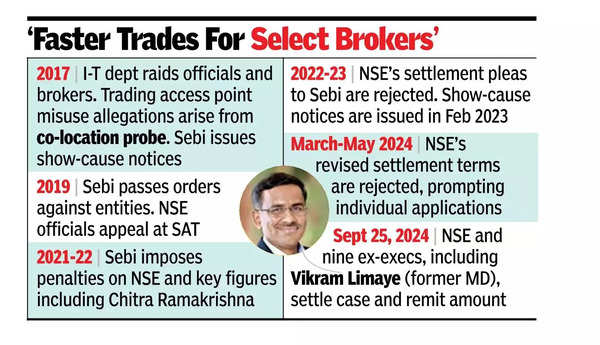

MUMBAI: NSE and nine of its former senior executives, including earlier MD Vikram Limaye, have settled a case with Sebi over allegations that brokers bypassed a trading access point to enable faster trades for Rs 643 crore. This is the largest settlement order in Sebi’s 36-year history. In addition to the settlement amount, eight officials have been asked to perform at least 14 days of pro bono community service.

Sebi has been investigating NSE’s trading access point (TAP) architecture and network connectivity for nearly a decade. The probe focused on whether trading members bypassed TAP, the handling of a 2013 complaint, and whether NSE’s lapses led to securities law violations. According to the order, NSE, on behalf of the applicants, remitted the settlement amount on Sept 25, 2024.

The former executives involved include NSE’s ex-chief technical officer Umesh Jain, GM Shenoy, chief information security officer Narayan Neelakantan, chief regulatory officer V R Narasimhan, head of regulatory affairs Kamala K, VP of the business solutions group Nilesh Tinaikar, former senior VP of operations Mayur Sindhwad, and former key employee R Nandakumar. Shenoy has been excluded from the community service order.

The key charge was that NSE failed to take adequate measures to prevent trading members from bypassing TAP. The complaint and TAP deficiencies were not reported to NSE’s Standing Committee on Technology, even after Sebi’s 2015 circular on cybersecurity. Additional allegations included delays in appointing a chief information security officer, failure to implement encryption in TAP, and the omission of the chief technology officer as key management personnel, potentially violating Sebi’s circular.

TAP was an IT system deployed by NSE on trading members’ servers to manage connections and trades. Despite the introduction of alternatives like ‘Trimmed TAP’ in 2013 and ‘Direct Connect’ in 2016, TAP remained in use until 2019 for equity and 2020 for securities lending and borrowing.