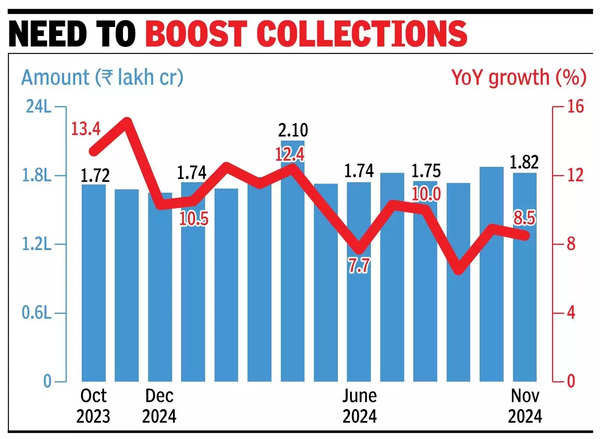

NEW DELHI: Goods and services tax (GST) collection rose 8.5% to Rs 1,82,269 crore in Nov, the fourth highest since the new regime kicked in over seven years ago.

The growth in Nov, based on transactions in Oct, was driven by domestic consumption, rising 9.4% to just under Rs 1.4 lakh crore, while imports saw a 5.9% increase, according to latest monthly numbers. While integrated GST on imports grew around 6.5%, cess on imported sin and luxury goods declined over 17%. The numbers indicated that overall imports may have increased, although at a moderate pace.

So far this year, gross collections have increased 9.3% to Rs 14.6 lakh crore.

The numbers come amid signs of a slowdown in consumption demand in some sectors and GDP expansion moderating to 5.4% during the Sept quarter, the slowest in seven quarters.

“The projected GDP growth of 7% in FY25 augurs well for GST collections in the remaining four months of the current fiscal year, considering the fact that the collections in the first eight months of FY25 have exceeded that of FY25 by more than Rs 1 lakh crore and are ahead of the budget estimates for FY25. The slower single-digit growth in some large states like Haryana (2%), Punjab (3%), UP & MP (5%), Tamil Nadu(8%), Telangana (3%) as well the negative growth in Rajasthan (-1%) , Andhra Pradesh ( -10%) , Chhattisgarh (-1%) would be an area of concern as these states have significant manufacturing presence and considerable economic impact,” said MS Mani, partner at Deloitte, a consulting firm.

Others also pointed to the need to boost collections. “The income tax and GST numbers are dichotomous it seems. While YTD (year-to-date) direct tax collections till Nov 10, 2024 have grown by more than 15%, the YTD GST collections in around that period have grown by only 9.3%. This shows that while income levels are growing in India, yet consumption is not aligned accordingly. It may also mean inequality of income in the country. Further, the YTD GST collections growth is also below the budgeted growth and considering that nominal GDP growth is around 10.5%, the buoyancy of GST collections is below one. This may require some food for thought for the GST Council,” said Vivek Jalan, partner at Tax Connect Advisory Services.