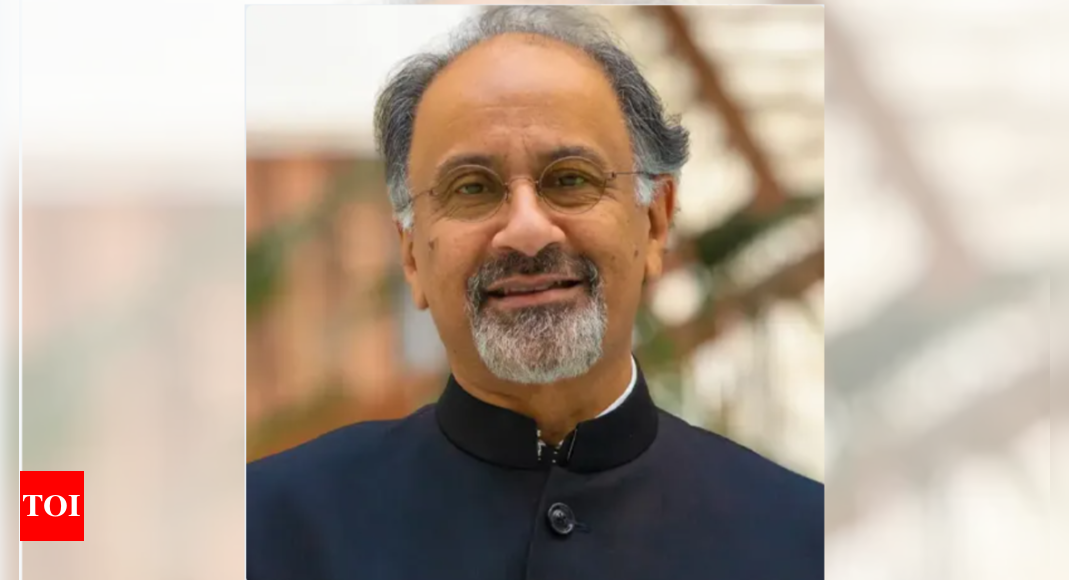

World Bank chief economist Indermit Gill believes there are several things going for India – from the demographics to geopolitics and from a large domestic market to low debt levels in the private sector. He tells TOI in an interview that India should seek to push its potential growth from 6% to 8% by focusing on greater efficiency and economic freedom and quality education and by staying open to FDI and trade.

What are the major concerns in the global economy? Are the problems facing middle-income countries like India unique and how they should deal with them?

In summarizing the problems facing the global economy, it is useful to think of the world as consisting of low-income countries, emerging markets, and advanced economies. The difficulties that each group is facing are distinct. Policy makers in advanced economies such as those in the Euro Area have brought inflation down and are now again worried about sluggish growth because of adverse demographics and slowing productivity growth. You can call this the problem of secular stagnation. In middle-income countries the problem is that, aside from a few exceptions like China, growth rates have not been high or steady enough for quick convergence to the living standards of advanced economies. We call it the middle-income trap. Low-income countries–mostly in Africa but also countries like Afghanistan, Yemen and Syria–have not been doing well since the mid-2010s. Their GDP growth rates have barely kept up with population growth, so their citizens have experienced zero or negative income growth. They have suffered a lost decade, and the prospects for the next decade are not much better. The global economy is settling down to a rate of growth rate much lower than what it was before the COVID crisis, which was in turn much lower than it was before the global financial crisis. So, with each crisis, the world economy seems to be coming down to a lower growth rate. In the case of middle-income countries that are home to 75% of the world’s population, the drop in GDP growth is especially rapid: from an annual average of 6% in the 2000s to 5% in the 2010s to a projected 4% in the 2020s.

So, what’s the way forward? What can middle-income economies do to reverse this dismal trend?

We have just completed a serious inquiry into this in the latest World Development Report. We have tried to distill the lessons from successful developers like South Korea and Taiwan in Asia, Poland and Hungary in Europe, and Chile and Uruguay in Latin America. These countries encouraged private investment by keeping inflation down and making things easier for enterprises, they brought in new technologies from abroad and made them widely available domestically (we call this infusion), and they displayed both patience and discipline in timing the shift to innovation-led development. China has also been doing many of the same things and there are signs that countries like India and Vietnam are also working towards a good mix of policies to encourage investment, infusion and innovation. What is working against today’s middle-income economies is that they are facing both a more difficult external environment–growing protectionism in advanced economies and rising concerns about climate change–and domestic difficulties like record levels of debt and rapidly aging populations.

What bright spots do you see in India?

India is a lot more fortunate than the typical middle-income economy. For the next two decades, it will have an extraordinarily favourable demography. Investors in advanced economies looking to diversify away from China find it attractive. It is a large and rapidly growing market, so foreign firms will become ever more interested in establishing operations in India. Its private sector is not heavily indebted–by one measure its private debt ratios are less than one quarter those of China’s. Its economy is more balanced than China’s: in that the ratio of consumption to GDP is normal, so it depends less on foreign consumption and its economic growth will not be as threatening as was China’s growth during the last two decades. Even the geopolitics are quite favourable for India. I would say that during the next two decades, India will be at prime potential; put another way, the Indian economy will never again be able to grow as much as it can over the next two decades. It cannot miss this golden opportunity.

In a recent piece you estimated that it may take India 75 years to reach one fourth of the US per capita income. How can it shrink this timeframe?

The 75-year estimate is not written in stone; that time period can be shrunk by decades. As I said, India will be at peak potential between now and 2047; the question is how to realize that potential. We estimate India’s potential growth rate at about 6%, it should be pushed up to 8%. India needs to become more efficient in the use of capital, skilled labour, and energy. Increasing efficiency requires some serious structural reforms: becoming more open to foreign investment, trade and technologies; using the talents of women and disadvantaged sections of society better; and using energy more efficiently by better pricing and regulation, and reforming state-owned enterprises that generate, transmit and distribute power. It has to as much in education as it has done so successfully in digital infrastructure and roads. India also needs to invest more, and that investment has to come from the private sector. Luckily, India’s private enterprises are in good shape for this.

It’s not as if you have to do it over the next two years; India has a window of two decades. But things will never be as good again when this period is over, so it must be done with a sense of urgency. I think the Prime Minister has done exactly the right thing by setting the goal of Viksit Bharat by 2047.

Women participation in the workforce is something that has been talked about a lot in recent years. What is the solution?

The solution probably consists of three parts. The first is to determine the facts. There is a lot of disagreement about what the female labour force participation rate is in India. There is no such controversy in, say, China or the United States. This needs to be sorted out. After meeting with experts in MOSPI, I am hopeful that it soon will be. Second, after we agree on the facts, I expect the solutions to improve women’s work participation will be different in different parts of the country, say in the Hindi-speaking belt as compared with the South. In some places or sections of society the fix might be cultural, in others it might be education-related, and in yet others it might have to do with public safety. The third part will have to do with ensuring equal opportunity through well-designed and implemented legislation.

I think that the world grossly underestimates the economic benefits of better use of the talents of women and disadvantaged groups. The case of the US is eye-opening. In the 1960s and 1970s, when anti-discrimination legislation was first introduced, 94% of America’s lawyers and doctors were white men. Today, today that ratio is less than half that. Without these changes, the estimates are that US GDP would have been about a third lower than it is today. Viksit Bharat will be achieved decades sooner with such measures than it will be without them.

What about investments?

India has to invest in more in capital of all kinds: human, physical, financial and infrastructural capital. On infrastructure capital, India has been doing well. On physical and financial capital, things could be better: India’s private investment to GDP ratio has been essentially stagnant for the last decade and has room to grow. But India’s investment in human capital–especially in secondary schooling, polytechnics, and higher education–needs to increase massively over the next decade. The main problem is not a shortage of money; the problem is more likely a serious shortage of political will to radically reorganize public education to prepare young people for a world of work that will be completely different from the time when these institutions were conceived. But I don’t sense any urgency when I speak with state governments. I get a sense of urgency when I talk to government officials in Delhi, though I also detect frustration that they can’t do much without state government support.

In September, a World Bank report talked about high tariffs in India and restrictive policies in services. In recent weeks,

What we recommend for smaller economies–there are more than 150 of them outside the G20–is to make trade and foreign direct investment easier, regardless of what richer or bigger economies are doing. India can do a lot more to improve the general conditions for foreign trade and investment. But when I listen to the debates among Indian economists, the talk is too much about whether to make a big bet on services or on manufacturing. For a large economy with both great potential and great inefficiency, the right way is to bet on everything: more on services, more on manufacturing, and more on agribusiness. A good place to start is to increase economic freedom, much as how Vietnam has done during the last five years. I know that the government is not an avid consumer of international rankings, but they do contain useful information. The Heritage Foundation’s Index of Economic Freedom, for example, has India ranked next to Nigeria and Brazil. Vietnam’s index is closer to Mexico’s and South Korea’s.

We recently interviewed

I agree completely with the CEA. Taxing wealth is about taxing people who have choices about where to keep their wealth. Besides, when you consider wealth and inheritance taxes, you have to account for the structure of the economy and the experience of countries that have experimented with high wealth and inheritance taxes. In India, the preponderance of family-owned enterprises means that a sizeable part of an individual’s wealth is the value of the family firm. When the head of the family dies, the survivors will have to liquidate the firm or borrow to pay a high inheritance tax. Neither helps the firm become bigger. But India’s problem is to grow enterprises which tend to stay too small, not to shrink them even more. And there can be other complications where large publicly traded firms are involved. South Korea has a very high inheritance tax. If the head of a conglomerate dies and his or shares shares have to be sold to pay taxes, this sale can sharply reduce the share price (and the market value of the company).

Perhaps Professor Piketty’s ideas are well-suited for Western Europe where equity concerns might be more pressing than the desire for greater economic growth. India’s problem today is not one of high levels of inequality, it is one of great inefficiency. Professor Piketty’s proposal might make things better in France; in India, it will make things worse.