By Arjun Guha Thakurta

Gold has long held a cherished place in Indian culture, especially as a gift symbolizing prosperity and wealth during festivals like Dhanteras. It has always been popular in India, especially for its sentimental value and reputation as a safe-haven asset. But as investment trends evolve, is gold still the best choice for those looking to make a wise financial gift?

Understanding Gold as an asset class

Gold is traditionally considered a defensive asset, providing a safe haven during times of economic uncertainty. This sets it apart from growth-oriented assets like equity and real estate. Gold prices are influenced by factors such as central bank holdings, geopolitical tensions, and currency fluctuations.

For example, recent years have seen central banks worldwide, including in India, significantly increase their gold reserves. This growing demand from central banks, along with geopolitical events, has driven prices up. Despite this, gold’s performance over the long term has not consistently matched that of equity, which has a stronger track record in outpacing inflation.

Has gold consistently performed over the years?

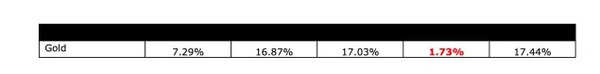

No, gold returns have not been consistent as the underlying factors driving the price of the metal are quite diverse and most often fear and sentiment is the factor that moves the price. The 5 year time frame returns range is 16%.

Has gold performed consistently?

Gold vs. Other asset classes

Equity tends to outperform gold in the long run, making it a more efficient growth asset. For instance, equity markets in India have generated approximately 12% annual returns over the past decade, compared to gold’s 8-10% with a higher standard deviation. Additionally, real estate has delivered average returns, often facing liquidity issues, which makes it less appealing than equities or even gold in some cases.

Gold vs other asset classes

Gold as a Gift

For those who value the sentimental aspect, gold remains an appealing choice, particularly for long-term keepsakes like jewelry. However, it’s essential to consider the potential downsides of gifting physical gold, including added costs for making charges, taxes, and potential liquidity challenges. Thus, we need to look at the alternatives of physical gold.

SGBs are the best way to take exposure to gold due to tax efficiency and the added 2.5% interest benefit; however, the government has not launched new tranches in the recent past. Therefore, the next best alternative to invest in gold is via Gold ETFs, as they invest in gold bullion of 99.5% purity. Gold FOFs are less efficient due to the added costs from investing via the FOF mode.

How Much Gold Should Be in a Portfolio?

For diversification, it’s best to limit gold exposure to about 5-10% of your total portfolio. This allocation provides a hedge against market volatility without sacrificing the potential for higher returns from growth assets like equity.

Is Gold the Right Financial Gift?

While gold remains a meaningful gift, it may not be the most financially advantageous option compared to other investments. For those looking to invest in gold for gifting, options like Gold ETFs or SGBs are preferable due to their cost efficiency and tax benefits. However, for purely financial growth, a more diversified investment strategy with a blend of equity and debt is likely to yield better long-term results.

Other Meaningful Financial Gift Options

In addition to gold, there are other impactful financial gifts that can set your loved ones up for a brighter future.

- Mutual Fund Units or Stock Units: You can gift mutual fund or stock units, introducing your loved ones to the power of long-term investment growth.

- SIP on Behalf of Loved Ones: Starting a Systematic Investment Plan (SIP) by opening a joint bank account and contributing regularly on their behalf can be a wonderful way to support their financial goals.

- Health or Term Insurance: Paying for a health or term insurance plan for your loved ones provides a gift of security, helping safeguard them against financial burdens from unexpected health issues.

- Financial Literacy: Arguably the best gift of all is financial literacy. Enrolling your loved ones in a course on money management can empower them to take control of their own financial future.

Ultimately, gold can be a wonderful gift choice when sentimental value is paramount. But for those aiming to make a more financially impactful gift, exploring a mix of growth and defensive assets might be the way forward.

The author is Executive Director, Anand Rathi Wealth Limited. Views expressed are personal