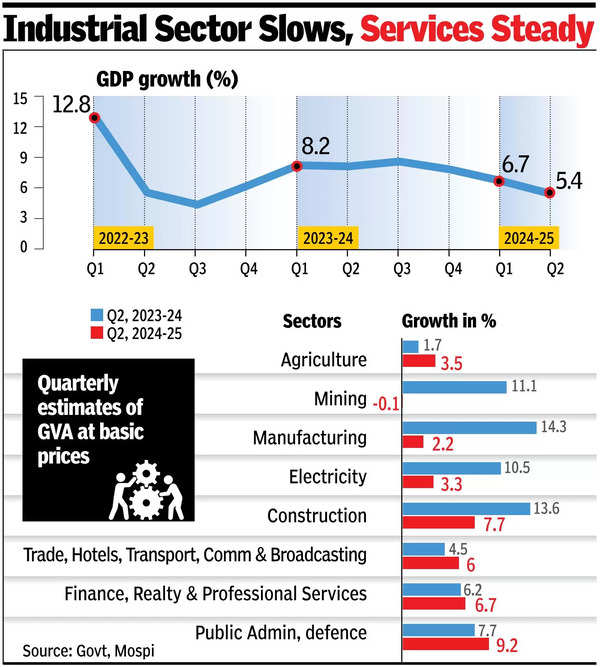

NEW DELHI: The country’s economic growth in July-Sept quarter of the current fiscal year slowed to a seven-quarter low, dragged down by slowing manufacturing and a contraction in mining. The services sector remained stable and the farm segment staged a rebound.

Data released by the National Statistics Office showed GDP grew by 5.4% in the three months to Sept, slower than the 6.7% in the April-June period and below the 8.1% recorded in the second quarter of 2023-24. It was also below the RBI projection of 7% for the three-month period ending Sept. The central bank has retained its forecast of 7.2% growth for 2024-25. Govt expects the economy to grow in the 6.5%-7% range. TNN

Growth slowdown sharper than expected, say experts

The slowdown in the second quarter was sharper than expected and pointed to weakness in consumption and investment. The slowdown, which has been anticipated, has been linked to several factors, including weather-related events such as excess rainfall that hurt electricity, coal and cement sectors, muted corporate earnings and the impact of stubborn inflation on overall demand. Chief economic adviser V Anantha Nageswaran said, “Real GDP growth print of 5.4% is on the lower side and it is disappointing but there are some bright spots.”

The manufacturing sector slowed sharply in the second quarter to 2.2% compared to an expansion of 14.3% in the year earlier three-month period. The mining sector contracted 0.1% compared to a growth of 11.1% in the second quarter of last year. The industrial sector slowed to a six-quarter low of 3.6%. The crucial services sector held steady and sustained its momentum, rising 7.1% in the three months to Sept compared to 7.2% in the previous quarter. The farm and allied sectors, which had remained sluggish in the previous quarters, bounced back growing by 3.5% compared to 2% in the previous quarter and 1.7% in the second quarter of last year.

“While the GDP growth was expected to moderate as indicated by some of the high frequency macro-economic indicators and weaker corporate performance, the quantum of deceleration is much sharper than expected. Lower growth is mainly because of poor industrial sector performance, specifically mining, manufacturing and electricity segments,” said Rajani Sinha, chief economist at ratings agency CareEdge.

“There has been a sharp moderation in investments. The govt’s capex that had been supporting growth so far saw a moderation, with the Centre and consolidated state capex falling by 15% and 11%, respectively, in the first half. However, the positive aspect is that consumption growth has remained healthy at around 6% in Q2,” said Sinha.